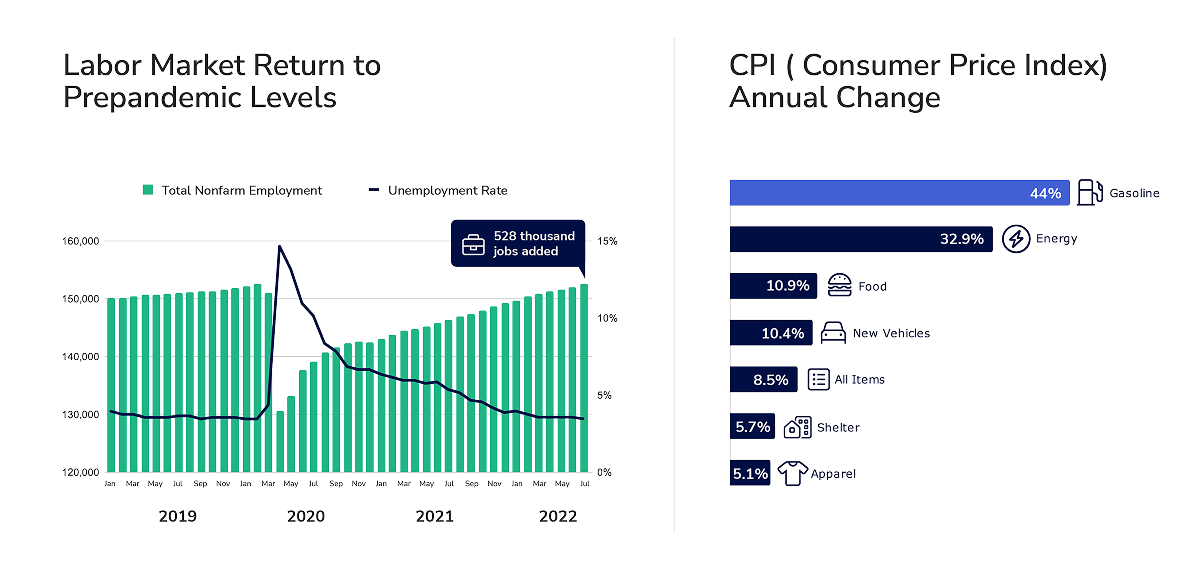

The economic environment has shown ambiguity with both healthy numbers, but also worrying trends. On one hand, economic data points to fundamental strength in many sectors. The labor market has shown resilience, with an unexpectedly high 528 thousand jobs added in July, bringing the jobs count above pre-pandemic levels for the first time. Job gains were widespread led by leisure and hospitality, professional and business services, and the healthcare industries.

On the other hand, GDP has declined for the 2nd straight quarter, signaling a technical recession. While inflation has slowed on an annual basis from 9.1% in June to 8.5% in July, it was mostly due to falling energy prices. Energy prices are still up 32.9% over the past year, compared to 41.6% in June. The Federal Reserve officials have signaled that they remain steadfast on aggressively fighting inflation, even if higher rates increase the risk of a downturn. The decrease in CPI is welcome news and traders are now anticipating a better chance of a lesser 50 basis point move on the federal funds rate, compared to the previously expected 75 bps increase by the Fed in September.

The combination of economic pressures and rapidly increasing interest rates has prompted a more cautionary approach from buyers. Commercial Real Estate activity began to slow in Q2 and have slowed further since. Despite concerns over the economic environment, the 10-Year has compressed to 2.8% as of August 8th. This is after it peaked at 3.4% in June, widening cap rate spreads slightly. Still, the increased cost of capital alongside moderating economic growth and softening sector fundamentals is expected to soften sale price appreciation as cap rates experience upward pressure. Despite this, some sectors and geographic regions remain more favorable than others.

While the economy has displayed mixed signals so far in Q3, the 10-Year has compressed to 2.8% as of August 8th. This is after it peaked at 3.4% in June, tightening cap rate spreads. With the recent compression in the 10-Year, the risk premium has improved across all property types. Still, the increased cost of capital alongside moderating economic growth and softening sector fundamentals is expected to soften sale price appreciation, although some sectors and geographic regions remain more favorable than others.

Commercial real estate transactions in 2021 were up ~30% compared to 2019, the previous annual high. Transaction volume for commercial properties remained strong in the first half of 2022, with a first half record of $278.3 billion in total sales volume. On a trailing four-quarter basis, New York was the top market, with $67 billion. Los Angeles followed with investment volume of $65 billion. Rounding out the top 5 were Dallas-Fort Worth, at $50 billion, Atlanta, at $40 billion, and the San Francisco Bay Area, with just under $40 billion in volume.

With the cost of capital increasing over the last few months, investors have slowed investment activity considerably. Through the month of July, transaction volume reached $40 billion and is on pace for $120 billion, which would represent a decrease of 22% compared to Q3 2021. Nearly 6,900 transactions closed in July, representing a decrease of 40% compared to Q3 2021. At the current pace, transaction volume would represent the lowest 3rd quarter since 2011, although sales volume would represent the 2nd largest since 2011.

The Multifamily sector continued its strong run into Q2 but demand has softened along with growth in rents. Despite inventory growth decreasing for the fourth straight quarter, demand has fallen short of the nearly 375,000 units that were delivered in Q2. After vacancy rates dropped to a historical low of 4.7% in the third quarter of 2021, they have now increased to 5.0%, a rate that still remains well below the historical average. Despite vacancy rate expansion, rents continue to climb at rates well above the historical average. Rent growth has cooled, but remains elevated, increasing 9.7% over the past year.

Despite strong fundamentals for the apartment sector, increased interest rates are creating concerns about the durability of property values. With the average market cap rate at 4.99% as of August, the apartment sector offers the lowest risk premium at 224 bps, down from 362 bps just one year ago. While the sector does benefit from the ability to offset higher nominal interest rates through annual rent increases, the current risk premium suggests cap rates expand for the sector. Still, opportunities remain throughout the sector. The spread between current Class A & B cap rates and the 10-year Treasury at the end of the July compressed to a 10 year low of 217 bps compared to the 10-year average of 346 bps for Class A & B units. While many Sunbelt markets have benefited from shifting migration patterns and elevated rent growth, opportunities exist throughout secondary and tertiary markets with elevated cap rates.

_Outline.svg)

The retail sector continues to benefit from robust consumer spending, pushing many retailers to selectively expand. This is despite increasing concerns over inflation and a potential economic slowdown. Typically, consumers cut back on non-essential spending during times of uncertainty or rising inflation.

With the average market cap rate at 6.78% as of August 1, a spread of 403 bps remains below the historical average but is favorable compared to other property sectores. With concerns over the economy, fundamentals for the sector are expected to soften as well, curtailing leasing activity, slowing rent growth, and putting upward pressure on cap rates as NOI decreases. Opportunities exist throughout though. Retail properties that sell necessities or are anchored around grocery stores are likely to outperform. Markets with strong migration patterns, such as many in the Sunbelt, will continue to experience demand, although more selectively as well.

_Outline.svg)

Demand for space is weakening once again, with net absorption falling back into negative territory and the pool of available sublease space expanding. Uncertainty remains the prevailing theme, as firms continue to debate workplace schedules and assess real estate requirements. Office usage remains nearly a third of pre-pandemic levels and office-using employment growth has slowed over the past few months.

With the risk of recession rising amid high inflation and aggressive Fed policy, fundamentals in the office sector are expected to remain weak over the near term. However, the long-term proposition remains enticing for many investors. While high interest rates, and the subsequent cost of debt will weigh on both activity and pricing going forward, the sector offers favorable yields relative to other property sectors. With an average cap rate of 6.84%, yields are as high as 409 bps compared to the historical average of 351 bps.

_Outline.svg)

Absorption of industrial space is robust, and asking rents remain strong. While softened economic growth and high inflation are likely to slow consumer spending, a record amount of capital has been raised for deployment in the industrial sector. Investors remain drawn to the Industrial sector given its potential for rent growth to exceed or at least keep pace with inflation, and the uncertain long-term leasing prospects in other major real estate sectors such as office and retail.

Investors remain drawn to the Industrial sector given its potential for rent growth to exceed or at least keep pace with inflation, and the uncertain long-term leasing prospects in other major real estate sectors such as office and retail. With the current spread above the historical average, industrial cap rates have room to compress further from the current yield of 333 bps.

_Outline.svg)

Interest rates and the consequent cost of capital are a factor in determining the future trajectory of property values, but they are just one of many factors. With the ability to adjust rents, the structural operating fundamentals of real estate make the asset class an attractive inflation hedge, driving transaction volume. While data still points to fundamental strength in the economy, there are signs of softening. The most recent CPI reading of 8.5% indicates softening inflation, although it remains elevated historically speaking and remains a real concern as the Fed will continue to curtail it with further increases in interest rates. The rising cost of capital along with softened property performance will reduce net operating income, putting upward pressure on cap rates.